Fast and secure. Even when travelling.

Travel expense software

Free yourself from time-consuming routine tasks and simply leave the expense management and travel expense reports of your employees to the HR software from rexx systems.

With the integrated solution from our partner Yokoy, all expenses such as mileage allowances, accommodation costs, meal allowances and hospitality are automatically listed in the travel expense report together with receipts. This makes expense claims transparent and, above all, error-free. Always in accordance with the applicable legal requirements, of course.

At the heart of the travel expenses module is an AI that continuously learns from the processes it runs through and adapts to the company’s requirements.

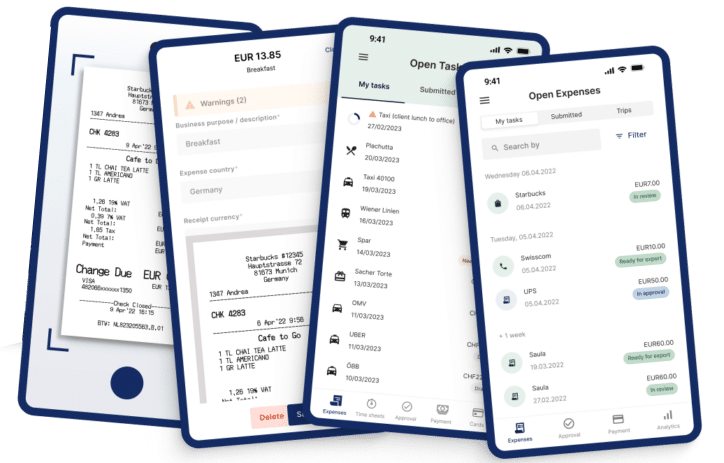

Expense management software - also via smartphone or tablet

The automated expense management process gives your HR more time to focus on issues that add real value to your company. Your employees can complete their travel expense reports online – even when travelling.

Quick overview of travel expense reports

- Travel data entry via employee portal

- Upload of electronic receipts

- Automated transfer of master & user data via rexx HR to Yokoy

- Transparent overview of submitted expense requests and travel expenses

- Secure and protected data transfer via API

- Simple activation of the interface

- Another building block for your complete HR solution rexx Suite

Travel expenses: Relief for travellers and accounting

Many people find creating a travel expense report following a business trip a tedious task. With the additional module Travel Expenses in the rexx Suite, high volumes of paper and enquiries from the accounts department due to unclear information are a thing of the past. Business trips, including all receipts, are recorded online and accounted for in accordance with current legal regulations. This means that you and your staff benefit at the same time: while you retain complete cost control over travel expenses at all times, your employees benefit from the accelerated processing thanks to the electronically supported workflow.

Whether domestic or foreign per diems, additional subsistence expenses or changes to VAT rates or mileage allowances: The module is always automatically kept up to date with the latest legal requirements. All adjustments run automatically in the background.

Simplified expense & travel expense accounting

With the new travel expenses module from rexx systems, the processing of expenses and travel costs is simple and secure. Thanks to the solution integrated into the rexx Suite, expenses such as mileage allowances, accommodation costs, meal allowances or entertainment are automatically processed in the travel expense report with the help of artificial intelligence.

Time savings in travel expense accounting - both for employees and for the HR department

Both companies and employees benefit from the seamless integration of the Yokoy Expense module into the rexx systems software.

The HR department gains transparency and an overview of travel expenses incurred and can therefore focus on tasks that bring real added value to the company.

In addition, the electronically supported workflow means that employees are pleased with the accelerated processing and reimbursement of frequently incurred expenses. The availability of the solution as a smartphone app also makes it possible to submit travel expenses while travelling. Receipts can be scanned in immediately and submitted for processing with just a few clicks.

In addition to the simplified submission of expenses, the new module also supports the verification of receipts. Compliance guidelines and internal regulations are not only mapped, but adherence to them is also automatically ensured. The scope for interpretation of internal regulations is limited thanks to predefined automatisms. This means that incorrect entries or possible cases of fraud are recognised automatically. In addition, legal requirements such as domestic or foreign per diems, additional subsistence expenses or changes to VAT or mileage allowances are automatically kept up to date.

FAQ travel expenses

How are travelling expenses reimbursed?

Travelling expenses include all costs incurred in connection with a business trip. These include, for example, travel costs – whether by car, train or plane – accommodation costs, additional expenses for meals and incidental travel expenses.

Travelling expenses are normally borne by the employer. The employer also benefits from this, as they can deduct the travel costs from tax as business expenses. Only in special cases is the employer not liable for the travelling expenses incurred. This may be the case, for example, if the distance from the home to the external workplace is less than the distance to the office. The employee can then deduct the travelling expenses incurred as income-related expenses from their income tax.

In any case, it is important to keep all receipts such as petrol receipts, hotel bills or public transport tickets and enclose them with the travel expense report. The golden rule applies here: no receipts, no money.

How does travel expense accounting work?

There are no formal requirements for the travel expense report. From a legal perspective, it requires neither a signature nor a specific form or format. In theory, the travel expense report can therefore be completed by hand on a sheet of paper. In practice, however, it is advisable to use a form. A structured form makes it easier for the accounting department and the tax office to check the figures and avoids unnecessary errors or missing information.

A travel expense report is always required when the company sends employees on a business trip. On this business trip, the employee carries out an activity for the company outside of the fixed place of work. It should be noted that not all external work automatically counts as a business trip. A visit to a customer who is two blocks away from the normal place of work cannot, with the best will in the world, be considered a reimbursement of travelling expenses. From a legal point of view, a business trip can already exist if the destination is outside the city limits. This can all be found in the Federal Travelling Expenses Act (BRKG).

How are the travelling costs calculated?

Employees have a choice of three different ways to claim the costs of travelling by car. The simplest method is reimbursement in the form of a kilometre allowance, also known as a distance allowance or commuter allowance. This was increased from 30 to 35 cents per kilometre from the 21st kilometre at the beginning of 2021. For motorbikes and the like, 20 cents can be claimed. Co-drivers have had no entitlement since 2015.

In principle, it is also possible to charge the actual expenditure or a kilometre rate, which depends on the vehicle. In both cases, it is necessary to keep a logbook, which can be quite time-consuming.

What is included in accommodation costs and additional catering expenses?

If an employee stays overnight in a hotel on a business trip, the company reimburses these costs.

Additional catering expenses are the trickiest and most complicated area when it comes to business trips. It involves reimbursing expenses for food and drink. A sliding scale applies here. For a domestic trip lasting between eight and 24 hours, 14 euros are to be estimated and 28 euros for business trips lasting 24 hours or more. The day of arrival and departure is generally subject to an additional meal allowance of 14 euros. It does not matter whether the employee was travelling for up to eight hours or longer on these two days. The additional meal expenses for breakfast included in the price must be reduced accordingly.

What are the differences between domestic and international travel?

When travelling abroad, the billing of additional meal expenses is even more complicated. This is because the flat rates to be charged depend on the destination. For a business trip to China, between 30 and 74 euros are charged for full days, depending on the exact destination, and between 44 and 58 euros for France. The Federal Ministry of Finance regularly publishes corresponding lists. The flat-rate accommodation allowances for business trips abroad are adjusted to the typical costs of the country. For example, the lump sum for accommodation costs in Latvia is 76 euros, whereas in Tokyo it is 233 euros.

How can employers simplify travel expense accounting?

Accounting for travel expenses is a tedious but necessary task. Particularly in companies where business trips occur very frequently, travel expense accounting should be largely automated with the help of appropriate expense and travel expense accounting software. On the one hand, this reduces the error rate and, on the other, simplifies travel expense accounting considerably.

Incidentally, there is no legal obligation for companies to prepare travel expense reports. This means that employers do not necessarily have to pay their business travellers’ meals and accommodation allowances. Employees can then declare the costs incurred as income-related expenses in their income tax return.